Digital Transformation and Multi-Level Collaboration in Regional Tax Data Collection: A Case Study of Local Governments in Indonesia

Transformasi Digital dan Kolaborasi Multi-Level dalam Pendataan Pajak Daerah: Studi Kasus Pemerintah Daerah di Indonesia

DOI:

https://doi.org/10.21070/jkmp.v13i1.1824Keywords:

Digital Transformation, Multi-level Collaboration, Tax Data Collection, PBB-P2, Local GovernmentAbstract

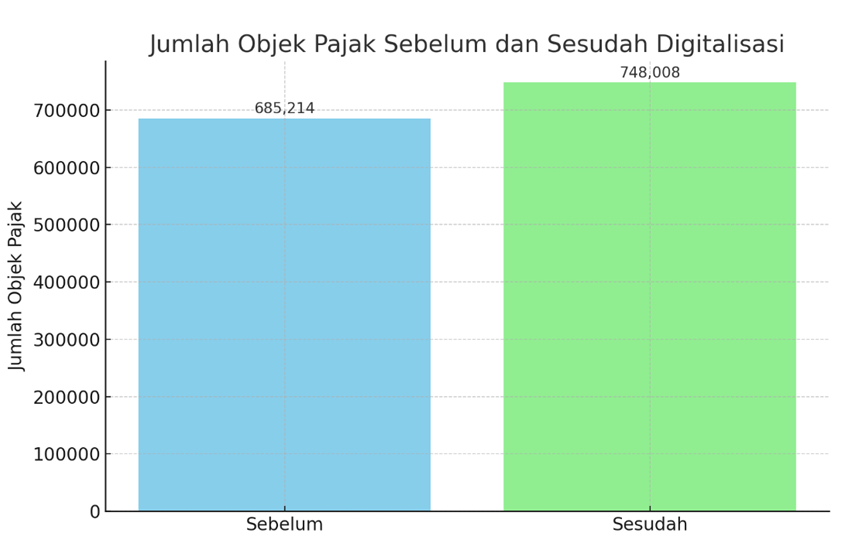

This study aims to analyze the contribution of digital transformation integration and multi-level government collaboration to improving the effectiveness of regional fiscal governance, with a case study on the collection of data on Rural and Urban Land and Building Tax (PBB-P2) in Jombang Regency. The approach used emphasizes the use of the E-SPOP application and GIS-based mapping system as the main instrument of digitalization, as well as synergy between Bapenda, sub-district governments, villages, and hamlet apparatus in supporting the data collection process. The results of the study show two main contributions: first, the expansion of the tax object database as indicated by the increase in verified data by 9.16%; second, fiscal administration efficiency through the acceleration of data collection and an increase in the average realization of PBB-P2 revenues by 13.5%. These findings strengthen the relevance of the Digital Governance, Socio-Technical Systems, and New Public Management approaches, respectively related to the role of technology, institutional readiness, and orientation to efficiency and accountability. The study also identifies replication challenges in other areas, such as infrastructure disparities and human resource capacity, but offers strategic opportunities through modular approaches and national regulatory support. Thus, the digitalization of regional taxation is proven to be not just a technical innovation, but as part of fiscal institutional reform that can be replicated to strengthen more adaptive, inclusive, and sustainable fiscal governance in various regions in Indonesia.

References

Allen, R., & Tommasi, D. (2001). Managing public expenditure: A reference book for transition countries. OECD Publishing.

Ansell, C., & Gash, A. (2007). Collaborative governance in theory and practice. Journal of Public Administration Research and Theory, 18(4), 543–571. https://doi.org/10.1093/jopart/mum032

Aulia, F. & Prasetyo, Y. (2021). Inovasi digital dalam pelayanan publik: Studi kasus sistem informasi daerah. Jurnal Ilmu Administrasi, 8(2), 145–160.

Bekkers, V., & Homburg, V. (2007). The myths of e-government: Looking beyond the assumptions of a new and better government. The Information Society, 23(5), 373–382. https://doi.org/10.1080/01972240701572929

Bird, R. M., & Vaillancourt, F. (2018). Fiscal decentralization and inclusive growth. International Centre for Tax and Development.

Bird, R. M., & Zolt, E. M. (2008). Technology and taxation in developing countries: From hand to mouse. National Tax Journal, 61(4), 791–821. https://doi.org/10.17310/ntj.2008.4.06

Bryson, J. M., Crosby, B. C., & Stone, M. M. (2015). Designing and implementing cross-sector collaborations: Needed and challenging. Public Administration Review, 75(5), 647–663. https://doi.org/10.1111/puar.12432

Dwiyanto, A. (2020). Digitalisasi dan transformasi layanan publik di Indonesia. Jurnal Administrasi Negara, 22(1), 11–25.

Dunleavy, P., Margetts, H., Bastow, S., & Tinkler, J. (2006). Digital era governance: IT corporations, the state, and e-government. Oxford University Press.

Emerson, K., Nabatchi, T., & Balogh, S. (2012). An integrative framework for collaborative governance. Journal of Public Administration Research and Theory, 22(1), 1–29. https://doi.org/10.1093/jopart/mur011

Grindle, M. S. (1980). Politics and policy implementation in the Third World. Princeton University Press.

Harsono, T., & Sari, I. P. (2022). Koordinasi fiskal antarlevel pemerintahan dalam pengelolaan data pajak. Jurnal Ekonomi dan Pemerintahan, 12(1), 73–84.

Hood, C. (1991). A public management for all seasons? Public Administration, 69(1), 3–19. https://doi.org/10.1111/j.1467-9299.1991.tb00779.x

Khadijah, A., Nurhidayat, T., & Anisa, F. (2021). Tata kelola pendapatan daerah dalam perspektif fiskal desentralisasi. Jurnal Administrasi Publik, 7(2), 134–146.

Lestari, D., & Adisasmita, R. (2019). Modernisasi sistem perpajakan daerah: Dampaknya terhadap kepatuhan wajib pajak. Jurnal Ilmu Ekonomi Terapan, 3(2), 89–101.

Machmuda, E., Firdausi, M. A., & Wulandary, R. F. (2024). Inovasi pelayanan perpajakan daerah berbasis digital: Studi kasus Desa Mancilan Kabupaten Jombang. Jurnal Inovasi Kebijakan dan Manajemen Publik, 5(1), 45–56.

Margetts, H., & Dunleavy, P. (2013). The second wave of digital-era governance: A quasi-paradigm for government on the Web. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 371(1987), 20120382. https://doi.org/10.1098/rsta.2012.0382

Mergel, I., Edelmann, N., & Haug, N. (2019). Defining digital transformation: Results from expert interviews. Government Information Quarterly, 36(4), 101385. https://doi.org/10.1016/j.giq.2019.06.002

Miles, M. B., Huberman, A. M., & Saldaña, J. (2014). Qualitative data analysis: A methods sourcebook (3rd ed.). SAGE Publications.

OECD. (2019). Digital government review of Brazil: Towards the digital transformation of the public sector. OECD Publishing. https://doi.org/10.1787/9789264307636-en

Putra, G. A., Lestari, P. D., & Sunaryo, H. (2020). Tantangan digitalisasi pajak daerah dalam mendukung PAD. Jurnal Pajak dan Keuangan Daerah, 4(1), 23–34.

Scott, W. R. (2008). Institutions and organizations: Ideas and interests (3rd ed.). SAGE Publications.

Setyowati, R. A., & Rakhmawati, A. (2022). Transformasi digital dalam tata kelola pemerintahan desa. Jurnal Inovasi Pemerintahan, 10(2), 119–130.

Simanjuntak, S., & Yuliani, N. (2020). Permasalahan kepatuhan wajib pajak dalam konteks pajak daerah. Jurnal Kebijakan Publik, 11(1), 55–67.

Siregar, A., & Hamid, S. (2021). Akurasi data objek pajak sebagai dasar optimalisasi PBB-P2. Jurnal Pajak dan Pelayanan Publik, 6(1), 23–34.

Sørensen, E., & Torfing, J. (2021). Interactive governance for wicked problems: A pluralistic and democratic theory. Oxford University Press.

Tamrin, M. H., Muhafidin, D., Nurasa, H., & Muhtar, E. A. (2024). Research mapping of policy network: A bibliometric analysis. Chinese Public Administration Review, 15(1), 57-71. https://doi.org/10.1177/15396754241227988 (Original work published 2024)

Torfing, J., Peters, B. G., Pierre, J., & Sørensen, E. (2012). Interactive governance: Advancing the paradigm. Oxford University Press.

Wibowo, T., & Handayani, D. (2021). Sistem informasi perpajakan dan pengaruhnya terhadap kinerja pajak daerah. Jurnal Teknologi Informasi untuk Administrasi Publik, 9(1), 44–57.

World Bank. (2020). Digital government in developing countries: Building capabilities and institutions. World Bank Group.

Yin, R. K. (2018). Case study research and applications: Design and methods (6th ed.). SAGE Publications.

Yustika, A. E., & Ramadhani, R. (2020). Integrasi sistem digital dan kapasitas fiskal daerah. Jurnal Ekonomi dan Kebijakan Publik, 7(3), 221–233.